Employee Retention Credit — Expanded Opportunities for Businesses

~~IMPORTANT UPDATE on ERC eligibility dates!~~

See our blog post of October 20, 2021

Wednesday, September 29, 2021 – Among the many COVID relief programs is the powerful but complex Employee Retention Credit. This significant credit received a boost earlier this year.

Here is the latest 411 on the Employee Retention Credit…

Dates Effective: March 13, 2020, through December 31, 2021.

Who is Eligible: Employers who were either subject to a government-ordered shutdown or who experienced a decrease in gross receipts at a prescribed level.

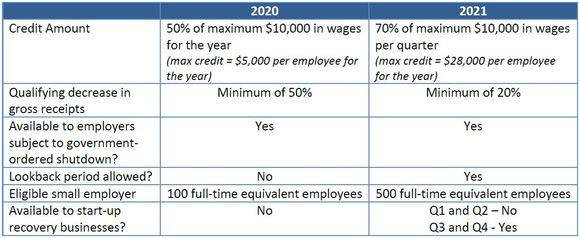

What is the Benefit: In 2020, the benefit can be as high as $5,000 per employee for the year. In 2021, it can be as high as $7,000 per employee per quarter, or $28,000 per employee per year.

More Benefits – Recovery Startup Businesses: The American Rescue Plan Act introduced the concept of a Recovery Startup Business (RSB). A RSB is a business which began operations after February 15, 2020, and whose gross receipts do not exceed $1 million. RSBs may qualify for an Employee Retention Credit of up to $50,000 in each of the third and fourth quarters of 2021.

Hurdles:

- The same wages cannot be used to qualify for any more than one of the following COVID-relief programs: Families First Coronavirus Relief Act (FFCRA), Paycheck Protection Program (PPP) loan forgiveness, and Employee Retention Credit.

- Wages of employees who are related to the owner do not qualify. The definition of “related” is very broad. If an owner has any living relatives, regardless of whether those relatives work in the business, then the owner’s wages do not qualify for the credit.

- If a business is not a small eligible employer, then only wages paid to employees who are not rendering services during the eligible period qualify for the credit.

How to Claim the Credit:

- The credit is claimed retroactively on Form 941-X; or,

- The credit can be claimed in advance on Form 7200 and then reported on an originally-filed Form 941.

The rules are VERY different between 2020 and 2021:

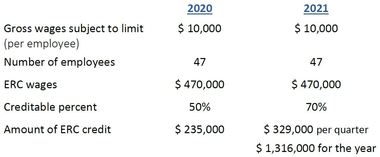

EXAMPLE of Potential Credit:

Assume an employer with 50 employees, 3 of whom are related to the owner. Also assume the business meets the gross receipts reduction threshold for each quarter in question. Each employee earns more than $10,000 in gross wages per quarter. No PPP forgiveness was received in the ERC covered period, nor were any FFCRA wages paid. The potential credit is calculated as follows:

Want help determining your eligibility or the amount of your credit? Give us a call and let’s discuss.